- Resources

- Corporate Relocation Survey

Corporate Relocation Survey 2025

CORPORATE RELOCATION SURVEY 2025

ATLAS® IS IN IT FOR THE LONG HAUL

Atlas® is pleased to bring you this 58th edition of our annual survey, the industry's first and longest-running study revealing trends and insights into corporate relocation policies and practices.

As we have done every year since 1968, we consider the demographic, geopolitical, and economic shifts affecting our industry. We analyze the findings and uncover the trends to understand the evolving challenges more clearly—and learn how we, as relocation professionals, can answer them.

SURVEY HIGHLIGHTS

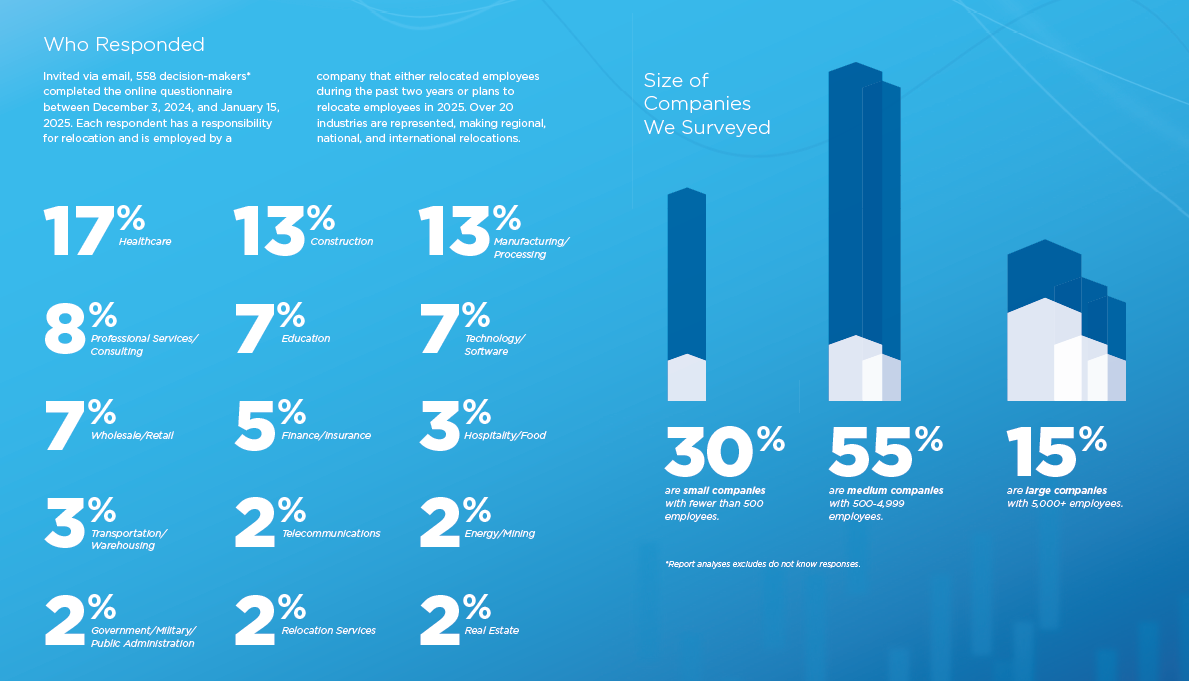

Survey results come from responses by 558 decision-makers, with a responsibility for relocation, and employed by a company that has either relocated employees during the past two years or plans to relocate employees this year. Over 20 industries are represented, making regional, national, and international relocations.

Overview AND Insights

Despite economic challenges over the past year, companies continued to invest in employee relocation, with most reporting an increase in relocation volume and budgets in 2024. While costs have risen in line with broader market trends, organizations remained committed to supporting talent mobility. Domestic relocation saw growth, and while international relocation volumes remained steady compared to 2023, stability in this area reflected ongoing global workforce needs.

In 2024, companies faced significant external and internal challenges that impacted employee relocation trends. Economic conditions remained the dominant external factor, affecting half of all companies—an increase from 2023—while real estate market fluctuations and rising mortgage rates added new complexities. Additionally, the ongoing talent shortage underscored the difficulty of finding qualified workers locally. Internally, company growth, restructuring, budget constraints, and knowledge/skills transfers were the top factors shaping relocation decisions. While budget pressures grew across all company sizes, organizations remained committed to workforce investment, with many offering competitive wages and relocation benefits.

Employee relocation trends showed signs of recovery in 2024. Only 58% of companies reported employees declining relocation, reflecting a willingness to relocate which had continued to trend upward from previous years (64% in 2023, 67% in 2022, and 68% in 2021). Family responsibilities emerged as the leading reason for declined relocation. Dual-income households also played a critical role, as partners’ employment situations influenced relocation decisions. Housing market volatility and rising mortgage rates further complicated feasibility. Employers responded with improved financial support, reducing relocation declines due to insufficient assistance. These shifting dynamics highlight the evolving priorities of today’s workforce and the need for organizations to adapt their relocation strategies accordingly.

Most companies agreed that relocation expenses were a valuable investment in talent recruitment and retention. While roughly a third of companies have faced challenges in retaining employees due to relocation policies, many have adapted their approaches. This survey revealed a shift away from standard, one-size-fits-all policies toward more flexible, customizable relocation benefits tailored to employees’ needs. As more companies embraced policy-dependent benefits, they created opportunities for a more personalized and supportive relocation experience.

Full, on-site return to work trended up for over 60% of companies. Simultaneously, remote work policies were refined to align with business needs, including the implementation of mandates for remote employees. Productivity remained a key focus, alongside talent recruitment and retention, as companies built workplace models that support business success and employee engagement. The desire to attract and retain talent left companies exploring their options. Data indicated that companies would consider relocating their operations or leasing additional office space. These strategic moves reflected a commitment to creating appealing workspaces while also optimizing costs in cities and states that offer tax breaks and moving incentives.

In 2024, artificial intelligence (AI) became even more integral to the workplace, transforming how businesses operated and made decisions. Companies of all sizes integrated AI to streamline processes, improve efficiency, and enhance productivity. According to respondents, AI adoption remained high, with almost all companies using it in their day-to-day operations and about one-third relying on it most of the time. Many businesses reported increased AI usage compared to 2023, with expectations for further growth in 2025. Investments in AI also grew, particularly among medium-sized companies, as organizations anticipated long-term benefits, especially in HR functions. AI played a crucial role in talent acquisition, streamlining recruitment, and enhancing relocation processes. While AI use expanded in key areas like employee monitoring and candidate evaluation, some functions, such as writing emails and training documents, saw a decline.