- Resources

- Corporate Relocation Survey

- POLICY ADMINISTRATION + ASSISTANCE

Corporate Relocation Survey 2025

POLICY ADMINISTRATION + ASSISTANCE POLICIES

RELOCATION POLICY

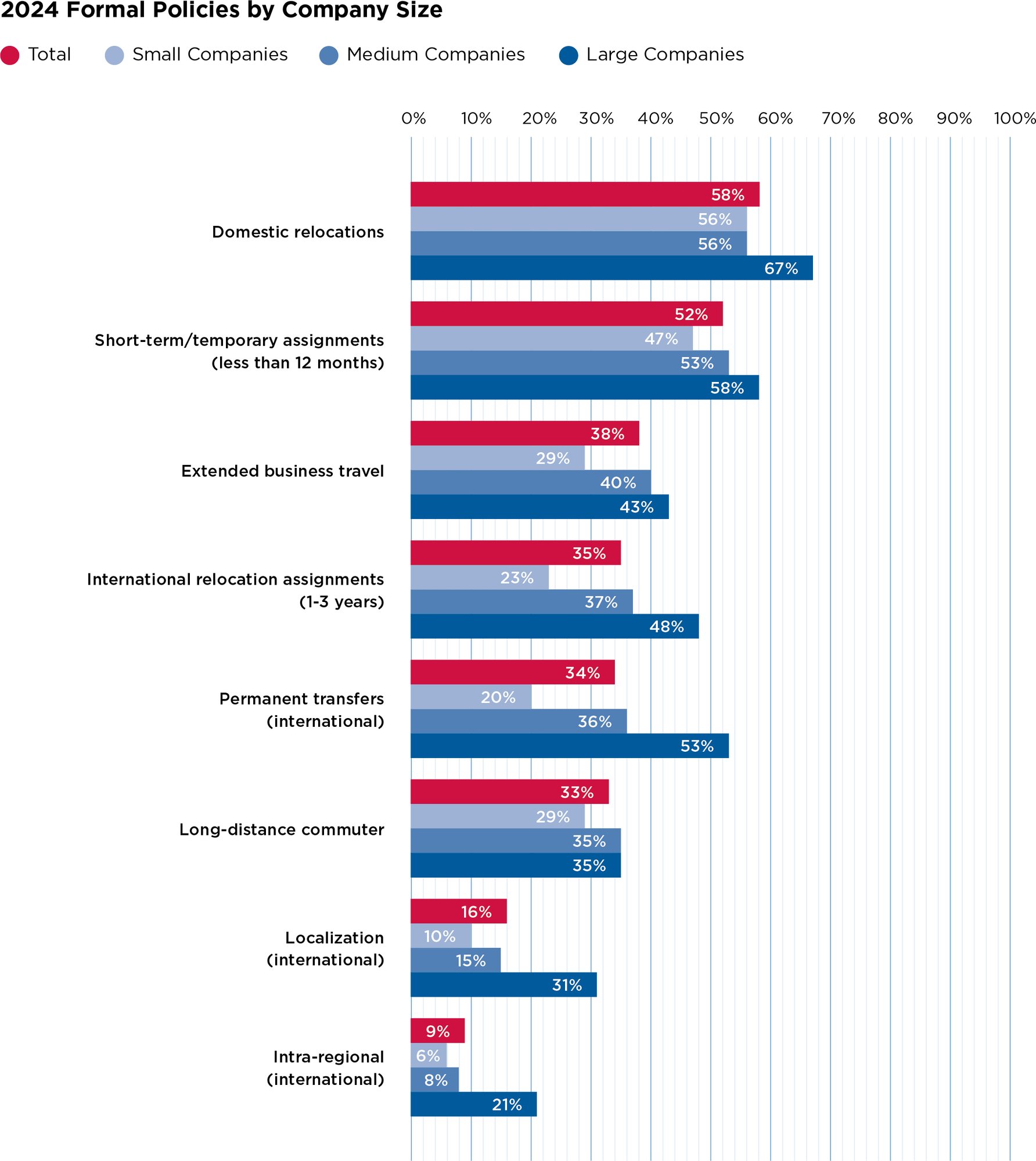

Most companies reported that they have a formal policy for domestic relocations (58%) and short-term assignments (52%). Roughly a third of companies reported policies for extended business travel (38%), long-distance commuter (33%), permanent transfers (34%), and international relocation assignments (35%).

When asked, 47% of companies agreed or strongly agreed that they lost good employees due at least in part to a corporate relocation policy. Yet, there were fewer formal relocation policies reported in 2024. In fact, there was no growth in formal relocation policies at all. Instead, there was at least a 16-point drop in all types of formal relocation policies compared to 2023.

RELOCATION BENEFITS

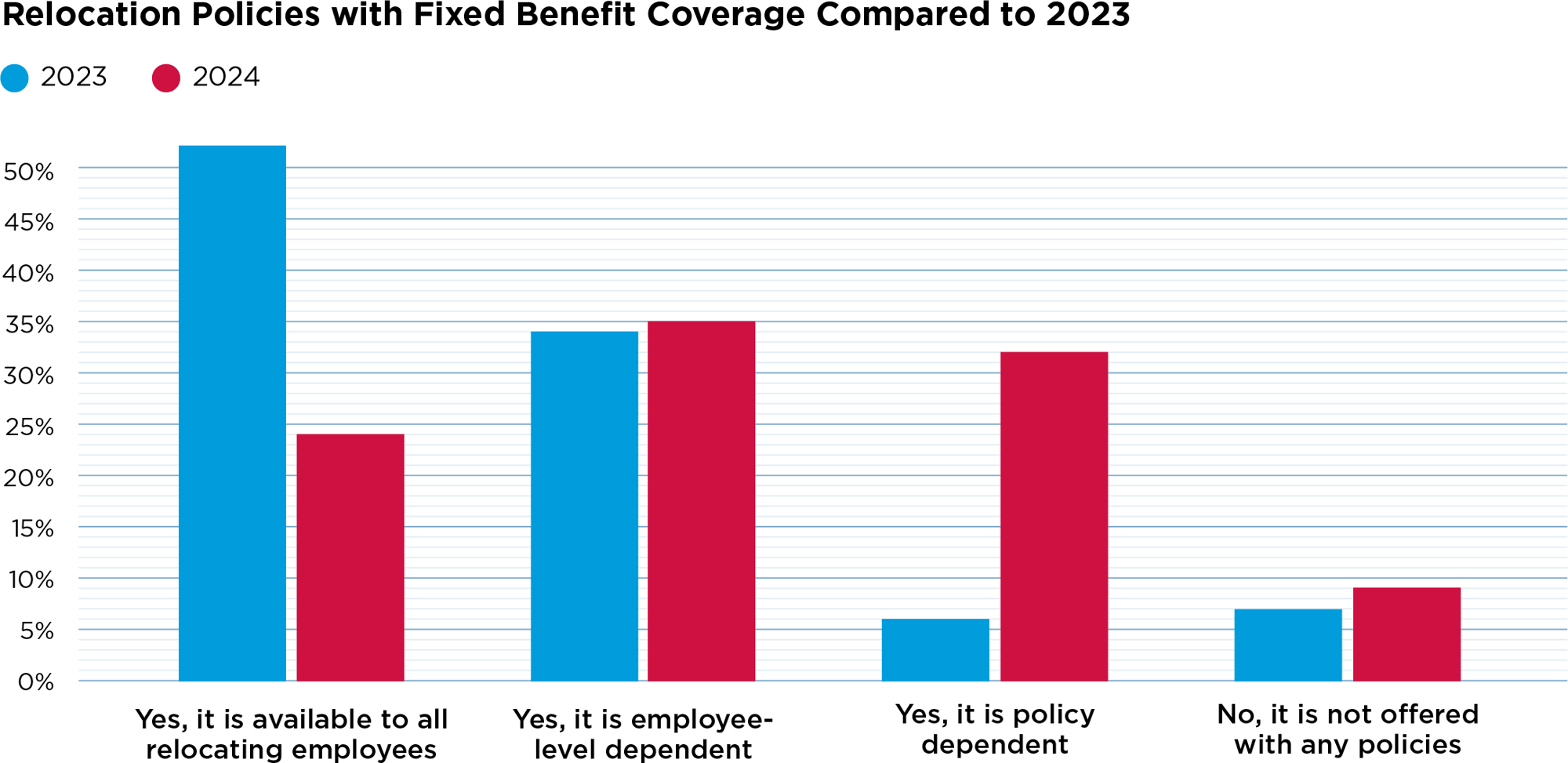

There was another notable change in 2024 around relocation policies. More companies reported that fixed- and flexible-use relocation benefits became policy-dependent and moved away from being available to all relocating employees.

- 32% of companies reported that fixed relocation benefits were policy-dependent compared to merely 6% in 2023.

- 36% of companies reported that flexible use of the full relocation benefit coverage are policy dependent compared to 12% in 2023.

The most common fixed benefits in 2024 were:

- Travel expenses-final move (52%)

- Temporary housing (51%)

- Household goods shipping (42%)

- Rental assistance/transaction costs (42%)

Most relocation policies incorporated flexible use of the full relocation benefit coverage amount to a list of possible services (88%).

ALTERNATIVE ASSIGNMENTS

Many companies reported utilizing alternative assignments in 2024, most often domestically on a limited basis. The desire to accommodate employee needs drove more companies to use alternative assignments in 2024 (33%) versus 2023 (22%). There was also a slight uptick in plans to use alternative assignments in 2025.

REIMBURSEMENT PRACTICES

Last year saw shifts in how companies handled relocation reimbursement practices.

Partial reimbursement based on salary, position, or policy tier was up (52%) while all other reimbursement types, including lump-sum, (35%) were down.

The types of employees who received a lump-sum payout changed slightly. More experienced professionals (58%), homeowners (40%), entry-level employees (37%), and new hires (31%) received a lump sum. Fewer executives (55%) and renters (23%) received a lump sum compared to 2023.

Ranges of lump-sum payment amounts shifted higher, too. In 2024, $10,000-$12,499 was still the most common amount offered. However, every range from $7,500-$9,999 to $25,000+ saw at least a four-point increase.

RELOCATION SERVICES

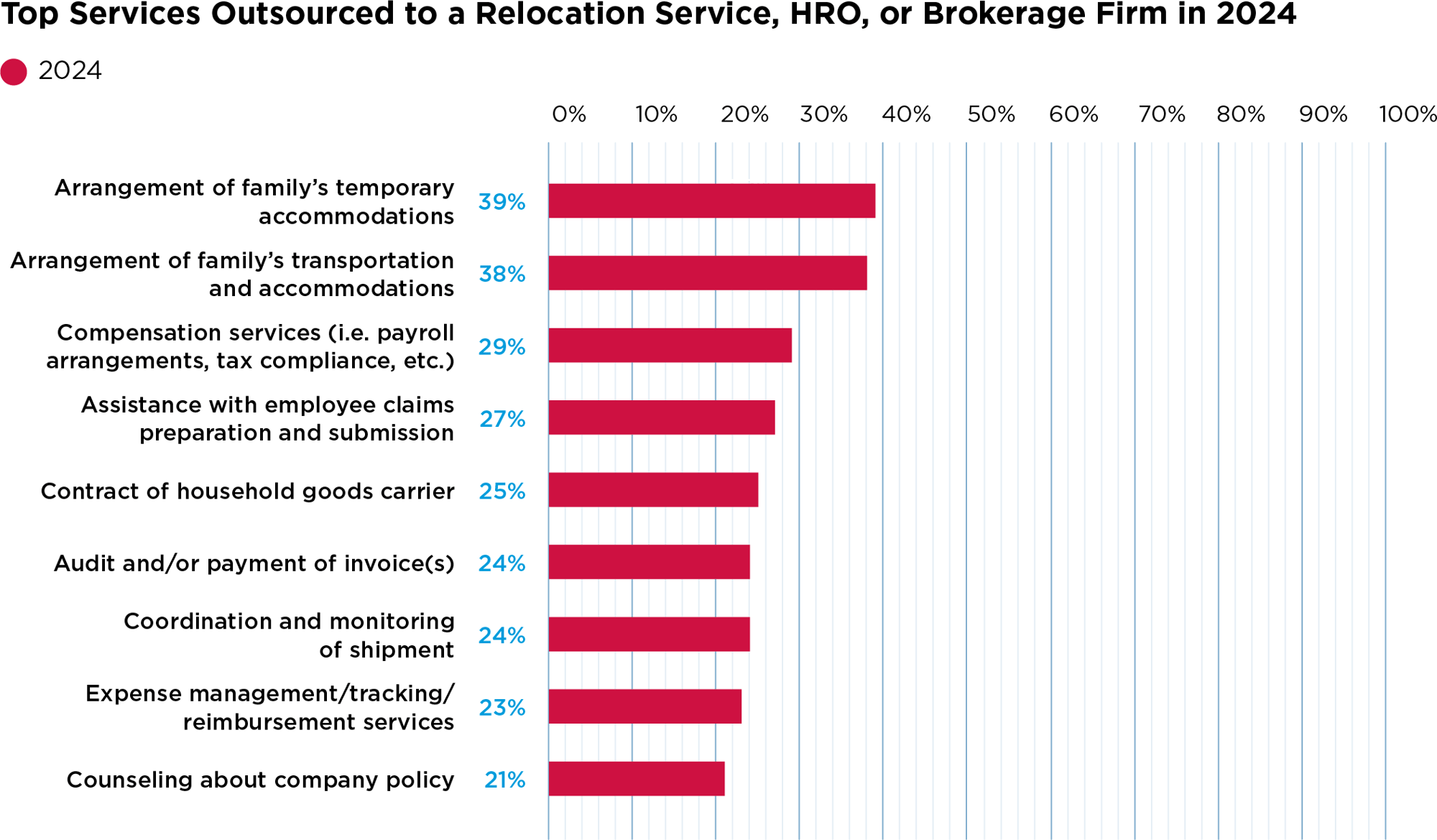

The most common services outsourced to relocation services, human resources out-sourcing (HRO), or brokerage firms in 2024 were:

- Arrangement of family’s temporary accommodations (39%)

- Arrangement of family’s transportation and accommodations (38%)

- Compensation services (payroll arrangements, tax compliance, etc) (29%)

- Assistance with employee claims preparation and submission (27%)

Similar to last year, most companies paid directly for carrier transportation expenses (66%), but there was an increase in expenses paid for by the employee and then reimbursed (32%).

ASSISTANCE POLICIES

The number of nonstandard incentives for corporate relocation remained mostly steady from 2023 to 2024 with a few exceptions. The top three most offered nonstandard incentives or exceptions were:

- 61% of companies offered cost of living adjustments (COLAs) to salaries at the new location, a 19-point increase from 2023.

- 53% of companies offered relocation/sign-on bonuses in 2024, a 9-point increase over 2023.

- 40% of companies offered extended temporary housing benefits in 2024, a 4-point increase from 2023.

Over half (51%) of companies said offering incentives or exceptions encouraged employee relocations “frequently” and 39% said these incentives “almost always” work.